Why Bookkeeping Calgary is crucial for small businesses

Wiki Article

Discovering the Trick Responsibilities of an Expert Bookkeeper in Finance

The duty of a professional accountant is essential in the domain name of financing. They are charged with maintaining precise financial records, handling accounts payable and receivable, and ensuring compliance with economic laws. Furthermore, their duty encompasses preparing monetary declarations and records. Each of these tasks contributes to the economic health of an organization. The subtleties of their work commonly go undetected, increasing concerns concerning the influence of their expertise on wider economic strategies.Maintaining Accurate Financial Records

Keeping accurate monetary records is an important responsibility for expert bookkeepers. This job needs thorough attention to information and a complete understanding of monetary concepts. Accountants are in charge of recording all monetary deals, guaranteeing that information is videotaped consistently and properly. They use various accountancy software and tools to enhance the recording procedure, which enhances effectiveness and minimizes the risk of mistakes.Regular reconciliation of accounts is essential, enabling bookkeepers to identify discrepancies and fix them quickly. By maintaining arranged and up-to-date documents, they provide useful insights into the financial health and wellness of an organization. This obligation also includes the prep work of financial statements, which act as a substantial source for management decision-making. Eventually, the accurate financial records kept by accountants sustain compliance with regulatory demands and foster count on amongst stakeholders, thus contributing to the total success of the organization.

Taking Care Of Accounts Payable and Receivable

Efficiently managing accounts payable and receivable is an essential facet of an accountant's function, guaranteeing that an organization's capital remains healthy and balanced. This responsibility entails monitoring inbound and outbound settlements, which enables prompt invoicing and collections from customers while additionally assuring that the company satisfies its economic responsibilities to distributors and vendors.

Accountants have to preserve accurate documents of billings, settlement terms, and due days, assisting in effective interaction with clients and lenders. By checking these accounts, they can determine discrepancies or past due accounts, allowing positive procedures to deal with problems prior to they rise.

Additionally, an accountant's function includes reconciling accounts to guarantee that all economic deals straighten with bank declarations and inner records. This diligence not just enhances economic openness yet also sustains tactical economic preparation, permitting the company to assign sources successfully and maintain a robust economic placement.

Making Sure Compliance With Financial Rules

While guiding with the facility landscape of economic policies, an accountant plays an essential role in guaranteeing a company follows legal criteria and guidelines. This obligation consists of staying upgraded on changes in tax laws, compliance demands, and industry-specific policies. Bookkeeping Services Calgary. By carefully tracking monetary purchases and maintaining exact documents, the accountant assists avoid infractions that could lead to penalties or lawful problemsIn addition, the accountant checks inner controls to protect versus fraud and mismanagement. They execute procedures that advertise openness and accountability within the financial structure of the company. Collaboration with auditors and regulative bodies even more solidifies conformity initiatives, as accountants offer needed paperwork and assistance throughout evaluations.

Ultimately, the dedication to compliance not only protects the company yet additionally boosts its reputation with stakeholders, cultivating trust fund and stability in its economic techniques.

Readying Financial Statements and News

Preparing economic declarations and records is a crucial job for bookkeepers, as it supplies stakeholders with a clear overview of an organization's monetary health. Bookkeeper Calgary. These records, which typically consist of the annual report, earnings statement, and capital declaration, sum up the economic activities and position of the business over a particular period. Bookkeepers diligently gather, document, and arrange useful site economic information to guarantee accuracy and conformity with appropriate accounting requirementsThe preparation process includes resolving accounts, Check This Out validating deals, and readjusting entries as required. With this thorough strategy, bookkeepers help guarantee that monetary declarations mirror truth state of the organization's financial resources. Furthermore, timely prep work of these records is vital for reliable decision-making by administration, financiers, and regulatory bodies. By giving specific and clear monetary paperwork, bookkeepers play a vital function in maintaining openness and depend on within the economic community of the company.

Giving Financial Insights and Analysis

Bookkeepers examine financial information to supply valuable insights that inform strategic decision-making within an organization. By carefully evaluating patterns in profits, costs, and cash money circulation, they aid identify locations for improvement and highlight potential threats. Bookkeeping Services Calgary. These insights enable administration to assign sources extra properly and readjust organization techniques appropriately

In addition, by leveraging financial software program and analytical tools, bookkeepers can provide data in a clear and understandable layout, making it simpler for decision-makers to understand intricate economic problems. Ultimately, the insights originated from an accountant's analysis encourage organizations to make educated choices that boost earnings and drive development.

Frequently Asked Concerns

What Software Equipment Do Professional Accountants Normally Use?

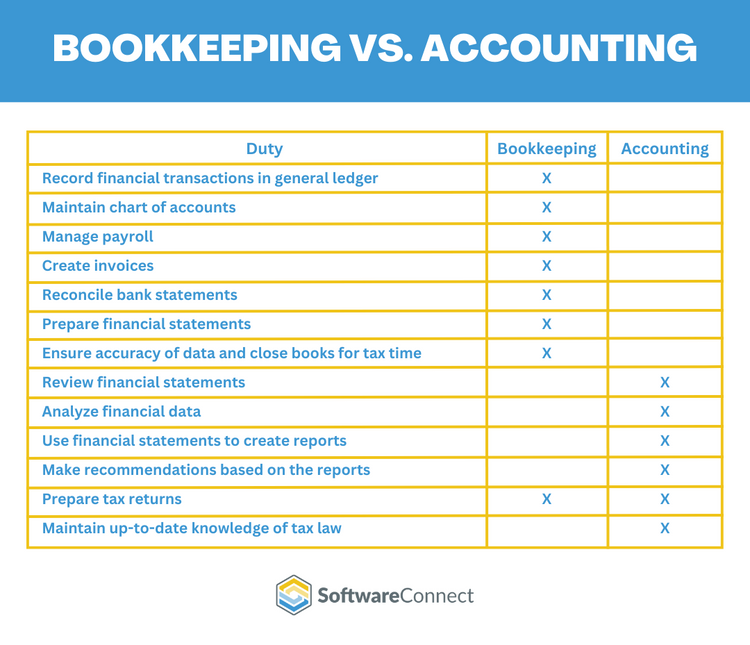

Professional bookkeepers commonly make use of software program tools such as copyright, Xero, Sage, and FreshBooks. These applications enhance monetary administration, facilitate precise record-keeping, and boost reporting capabilities, allowing for efficient handling of monetary purchases and information evaluation.How Does an Accountant Differ From an Accountant?

A bookkeeper primarily handles day-to-day economic deals and record-keeping, while an accounting professional assesses economic data, prepares statements, and uses calculated guidance. Their roles enhance each various other but concentrate on distinctive facets of financial administration.What Qualifications Are Needed to Become an Accountant?

To become a bookkeeper, people commonly require a secondary school diploma, effectiveness in accounting software, and knowledge of basic audit principles. Some may pursue accreditations or associate degrees to improve their certifications and task potential customers.Just How Commonly Should Financial Records Be Updated?

Financial documents need to be updated frequently, preferably on a day-to-day or regular basis, to assure accuracy and timeliness. This method permits efficient tracking of economic activities and sustains informed decision-making within the organization.Can an Accountant Assist With Tax Obligation Preparation?

Yes, an accountant can help with tax obligation prep work by arranging monetary records, ensuring exact documentation, and providing required reports. Their experience helps improve the procedure, making it less complicated for tax obligation specialists to complete returns effectively.They are charged with preserving exact financial documents, managing accounts payable and receivable, and making sure conformity with economic laws. Preparing financial statements and records is an important task for accountants, as it gives stakeholders with a clear review of a company's financial health. With this comprehensive technique, accountants assist assure that economic declarations mirror the real state of the organization's funds. check it out By leveraging monetary software program and logical devices, accountants can provide information in a comprehensible and clear style, making it less complicated for decision-makers to comprehend complex monetary issues. An accountant primarily takes care of day-to-day economic purchases and record-keeping, while an accounting professional assesses economic data, prepares statements, and uses calculated advice.

Report this wiki page